For the logistics industry, extreme phenomena have been going on for more than half a year. Whether it is congestion, shortage of empty containers, skyrocketing freight, including shortage of railway capacity, shortage of ships, and shortage of trucks, none of them constitute a single root cause. The problem now is that everything is in short supply.

A large backlog of heavy cabinets, international shipping companies have no choice but to “jump into ports”; freight rates have risen, and pressure on surrounding ports has increased… As the “central nervous system” of the global maritime logistics network — Yantian Port is caused by the “slowdown” of the epidemic The spread began to spread, and its impact on the global supply chain was far beyond imagination.

Yantian Port has a backlog of more than 200 million boxes of export containers. According to the arrangement, it is open to accept 5,000 a day, and the current processing capacity is only 1/7 of the usual.

This is the case at Yantian Port in Shenzhen, China. Looking at the world, the backlog of container ports in various places will only become more serious.

The Port of Oakland on the West Coast of the United States received 100,096 TEUs of imported containers in April of this year. This is the first time in the port’s history that imported containers exceeded the 100,000 mark in a single month. The port throughput star also reached 217,993TEU, a year-on-year increase of 8%. Container ships from Los Angeles Port and Long Beach Port in Southern California^ were diverted. CMA CGM and Wan Hai started to operate direct routes from East Asia to the Port of Oakland, bringing a large number of imported containers .

The port of Los Angeles, 635 kilometers away, is also submerged in a sea of containers: 946,966 TEUs in April, a year-on-year increase of 37.2%.

In the past month, the United States’ imports of containers from Asia achieved a year-on-year growth of 31%, reaching 1.57 million TEUs. In this situation, port congestion has become the norm. Just a few hours ago, Hapag-Lloyd announced that it would skip the Port of Oakland in its trans-Pacific West Coast service. When it will resume, it will depend on how the port will be relieved.

terminal on the West Coast of the United States

Hapag-Lloyd’s household consultation report warned US importers and forwarders that due to the surge in imports, all West Coast terminals are very congested, and the congestion is predicted to continue throughout the summer. According to Maersk, the average waiting time for ships in the Port of Los Angeles and Long Beach ranges from one to two weeks. There are about 40 ships in line at the two major ports: while ships in the Port of Oakland need to queue for three weeks to enter the port.

Many ports and wharves have no space for unloading containers, so they directly refuse to call ships.

The United States’ west coast ports are congested and the queue time is too long, which has seriously affected the schedule of the liner returning to Asia. Ships cannot return to Asia in time to load cargo. Congestion is almost equivalent to canceling the voyage. The effective capacity of trans-Pacific trade is once again restricted due to the availability of ports and cancellation of voyages. Maersk believes that since the beginning of this year, the capacity from Asia to the US West has lost 20%: It is estimated that from June to the end of August, the capacity will also lose 13%.

Port congestion means that ships are not on time and reliability is reduced. According to data from Sea-Intelligence Maritime Consultancy, 78% of ships arriving at the US West Port are delayed, with an average delay of 10 days. Flexport said that there may be delays in every handover link of the international supply chain. For example, the shipment from Shanghai to the Chicago warehouse has been extended from 35 days before the outbreak to 73 days today.

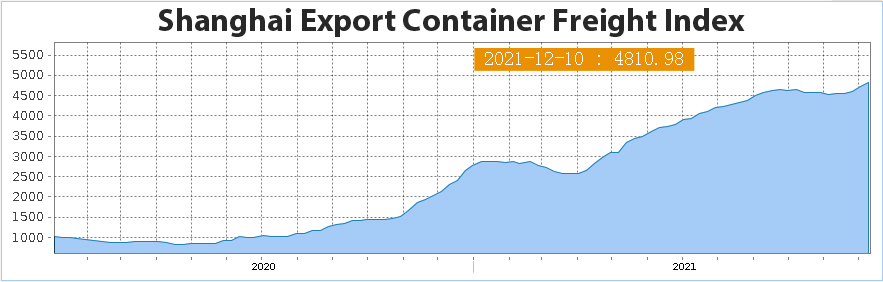

At the same time, container spot prices are also flying up.

There is a view that, in essence, there is no shortage of purely measuring the number of containers, ships, and goods that need to be transported. The root problem is that it takes longer to ship goods from Asia, North America, and Europe. In turn, it takes up more capacity space and aggravates the extreme degree of various problems.

To make matters worse, the extreme shortage of capacity means that there is no buffer capacity to deal with actual incidents.

A dangerous goods vessel exploded in the waters of Sri Lanka’s port, and a ship in Kaohsiung Port in Taiwan hit a dock crane. A port worker in Yantian Port in Shenzhen found a confirmed case of the new crown. A worker strike at a European port, these single incidents are constantly pressuring the chain, and it will take longer for the global supply chain to return to normal.